What is Ai Logistics Agents

Ai Logistics Agents has become a critical consideration for logistics and supply chain management professionals in 2026. As businesses face mounting...

Industry trends, supply chain strategies, and logistics technology insights for businesses moving goods at any scale.

18 articles

Ai Logistics Agents has become a critical consideration for logistics and supply chain management professionals in 2026. As businesses face mounting...

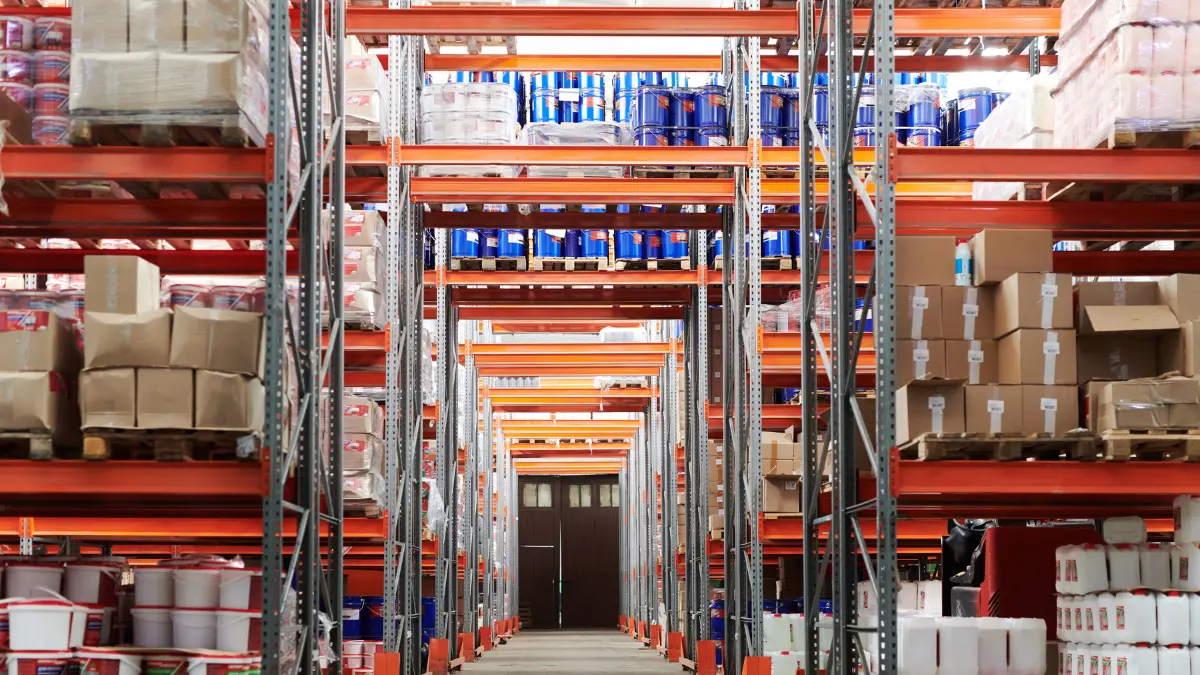

In the fast-moving world of logistics and supply chain management, warehouse management has emerged as a defining factor for operational success....

For logistics managers grappling with rising logistics costs, finding a practical, proven approach is essential. The landscape of logistics and supply...

In the fast-moving world of logistics and supply chain management, ways automation is changing warehouse management has emerged as a defining factor for...

In the fast-moving world of logistics and supply chain management, mastering green logistics 11 practical strategies has emerged as a defining factor for...

This comprehensive guide to streamlining waste management routes a guide for optimal efficiency is designed for procurement teams who want to move beyond...

In the fast-moving world of logistics and supply chain management, apc bolsters delivery with logistics tech company parcelly has emerged as a defining...

In the fast-moving world of logistics and supply chain management, 3pl businesses has emerged as a defining factor for operational success. Warehouse...

In the fast-moving world of logistics and supply chain management, challenges faced in supply chains has emerged as a defining factor for operational...

In the fast-moving world of logistics and supply chain management, inbound logistics and outbound logistics has emerged as a defining factor for...

Inventory Planning has become a critical consideration for logistics and supply chain management professionals in 2026. As businesses face mounting...

Reverse Logistics has become a critical consideration for logistics and supply chain management professionals in 2026. As businesses face mounting...